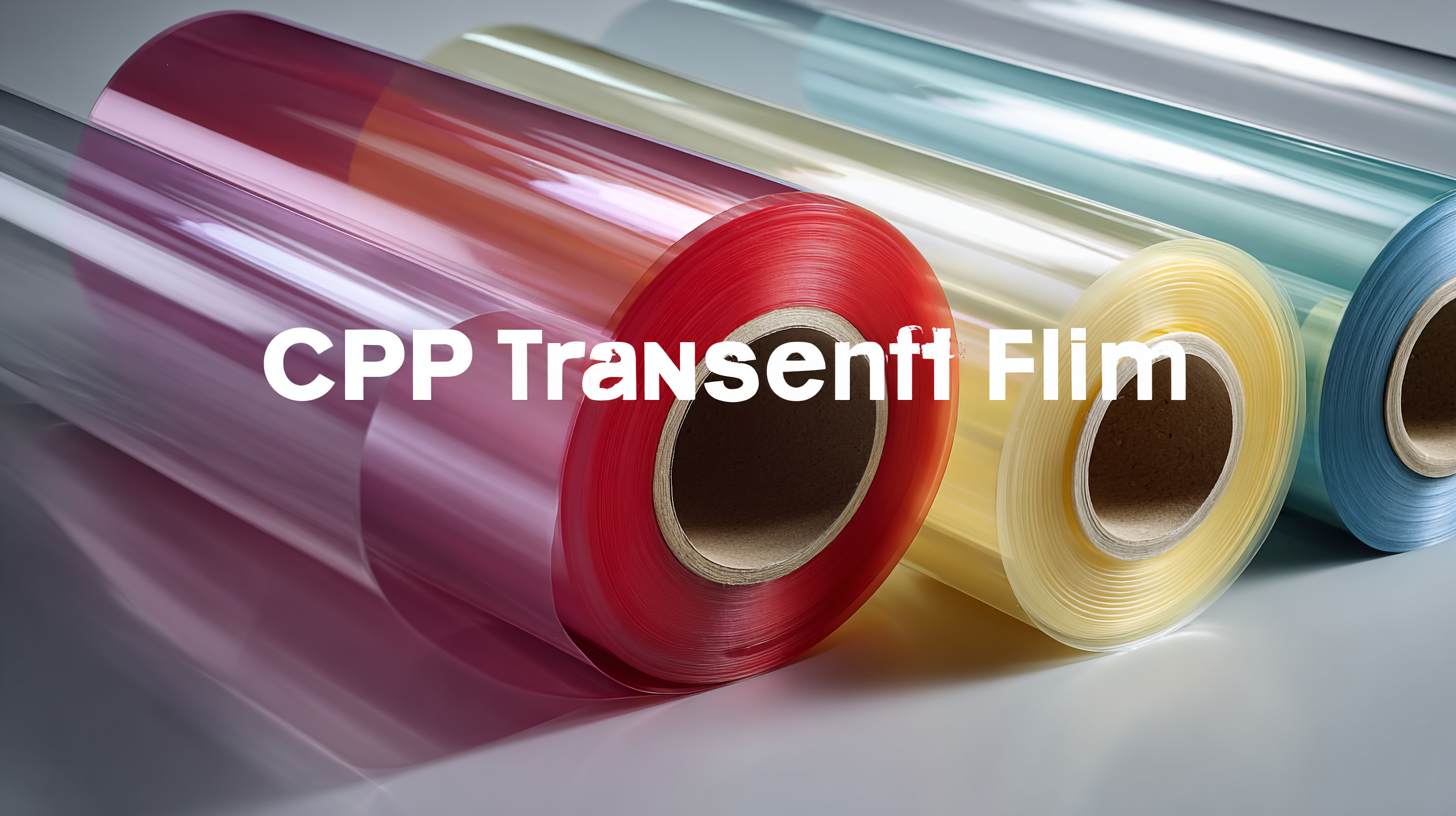

Crafting Excellence in Every Roll of Best CPP Translucent Film Made in China for Global Needs

In the ever-evolving landscape of packaging solutions, CPP Translucent Film has emerged as a crucial component in numerous industries, emphasizing the need for high-quality, reliable products. According to a recent market analysis by Smithers Pira, the global demand for polypropelyne films is projected to reach 9.8 million tons by 2025, with CPP films playing a significant role in this growth due to their versatility and superior barrier properties.

These films are particularly favored in food packaging, pharmaceutical sectors, and consumer goods, where the need for clarity and protection is paramount. As manufacturers in China strive to craft excellence in every roll of CPP Translucent Film, they not only meet local demands but also cater to an expanding international market, showcasing innovation and sustainable practices that reinforce their global impact.

The Rising Demand for CPP Translucent Film in Global Markets

The rising demand for CPP translucent film in global markets is a testament to its versatility and effectiveness in various applications. As consumers and industries alike seek sustainable and high-performance packaging solutions, CPP translucent film stands out due to its exceptional clarity and strength. This film is widely used in food packaging, consumer goods, and even medical supplies, where maintaining product freshness and visibility are paramount.

Moreover, the continued innovation in manufacturing processes in China ensures that the quality of CPP translucent film not only meets but often exceeds international standards. As the demand grows, manufacturers are adapting to market needs by enhancing production capabilities and diversifying product offerings. This trend reflects a broader shift towards more sustainable and reliable packaging solutions that can support a wide range of industries, ultimately positioning CPP translucent film as a preferred choice in today’s competitive marketplace.

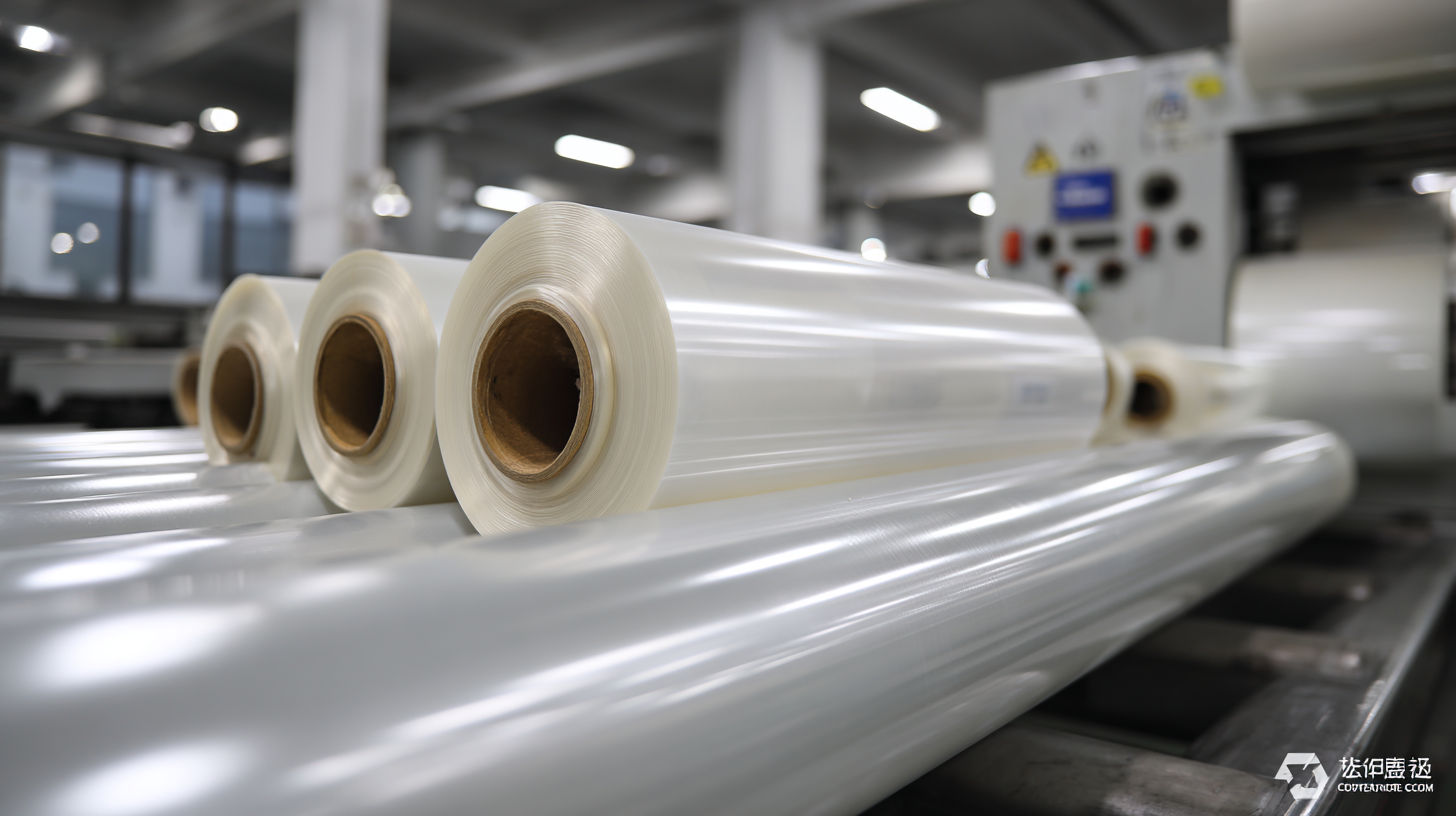

Innovative Manufacturing Techniques Driving Quality in CPP Film Production

The development of CPP (Cast Polypropylene) films has seen a transformative shift driven by innovative manufacturing techniques that enhance quality and performance. Notably, recent advancements in barrier technologies have elevated the production standards for CPP films, making them more suitable for a wide range of applications, particularly in the packaging industry. Reports indicate that the global CPP film market is expected to reach over $16 billion by 2025, driven by increasing demand for durable and high-performance packaging solutions.

Innovations such as high barrier CPP films, which provide superior moisture and gas resistance, are crucial in extending shelf life and maintaining product integrity. For instance, the introduction of advanced manufacturing processes has allowed leading production facilities to achieve significant improvements in barrier properties, contributing to a competitive edge in the market. As companies increase their focus on sustainability and environmental responsibility, the integration of new additive solutions and efficient processing techniques is shaping the future of CPP film manufacturing. This trend is underscored by the strategic investments and expansions being made by industry players to enhance production capabilities and meet global demand.

Sustainability Practices in the CPP Film Industry: A Focus for 2025

Sustainability is becoming increasingly vital in the CPP film industry as businesses align with global environmental goals. By 2025, the industry must embrace practices that prioritize resource conservation and reduce carbon footprints. Innovative technologies, such as biodegradable materials and advanced recycling processes, are paving the way for a more eco-friendly landscape within the sector. Companies can start by setting measurable sustainability targets that focus on minimizing waste and promoting circular economy principles.

One effective tip for manufacturers is to perform regular sustainability audits. This practice helps identify areas for improvement and encourages transparency throughout the supply chain. Additionally, partnering with suppliers who share a commitment to sustainability can amplify efforts toward a greener future. Engaging in community initiatives can also foster goodwill and enhance brand reputation.

Moreover, educating employees about sustainable practices is essential. Training programs can empower the workforce to contribute to sustainability goals. Simple actions, such as reducing energy consumption and optimizing production processes, can lead to significant environmental benefits. By embedding sustainability into the core of operations, companies in the CPP film industry can not only meet future requirements but also thrive in a competitive market.

Crafting Excellence in Every Roll of Best CPP Translucent Film Made in China for Global Needs - Sustainability Practices in the CPP Film Industry: A Focus for 2025

| Sustainability Practice | Current Status (2023) | Target Status (2025) | Notes |

|---|---|---|---|

| Use of Recycled Materials | 20% | 50% | Increase sourcing of post-consumer recyclables |

| Energy Efficiency | 70% of energy from renewable sources | 100% of energy from renewable sources | Implement solar panels across facilities |

| Waste Reduction | 30% waste recycling rate | 75% waste recycling rate | Establish zero waste policy |

| Water Usage | 200 liters/ton of film produced | 100 liters/ton of film produced | Invest in recycling water technologies |

| Sustainable Packaging | 40% sustainable packaging | 100% sustainable packaging | Shift to biodegradable materials |

Challenges and Opportunities for Chinese CPP Film Manufacturers in a Global Economy

The landscape of CPP (Cast Polypropylene) film manufacturing in China is defined by both challenges and opportunities in a rapidly evolving global economy. While Chinese manufacturers have established a reputation for producing high-quality translucent films, they face intense competition from international players. Factors such as fluctuating raw material costs, stringent environmental regulations, and the need for technological advancements pose significant challenges. To thrive, companies must adapt by investing in sustainable practices and enhancing production efficiency to meet international standards.

The landscape of CPP (Cast Polypropylene) film manufacturing in China is defined by both challenges and opportunities in a rapidly evolving global economy. While Chinese manufacturers have established a reputation for producing high-quality translucent films, they face intense competition from international players. Factors such as fluctuating raw material costs, stringent environmental regulations, and the need for technological advancements pose significant challenges. To thrive, companies must adapt by investing in sustainable practices and enhancing production efficiency to meet international standards.

On the flip side, the global demand for CPP films presents a plethora of opportunities for Chinese manufacturers. With the rise of e-commerce and flexible packaging solutions, there is an increased need for durable and versatile films. By leveraging their manufacturing scale and competitive pricing, Chinese producers have the potential to capture larger market shares. Efforts to innovate and expand product lines can further enhance their standing in the global arena, allowing them to forge partnerships and engage in cross-border trade effectively. As the industry evolves, the ability to navigate these challenges while seizing opportunities will be crucial for sustained growth and excellence in global markets.

Future Trends: Technology Advancements Shaping the CPP Translucent Film Landscape

The CPP translucent film industry is on the cusp of significant transformation, driven by technological advancements and a growing global demand for eco-friendly packaging solutions. Recent reports highlight that the global CPP film market is expected to reach USD 12.3 billion by 2025, reflecting a compound annual growth rate (CAGR) of 5.6%. This growth is being fueled by innovations in production techniques and a shift toward sustainable materials that cater to the environmental concerns of consumers.

As companies adapt to these trends, the integration of smart manufacturing technologies like IoT and automation is revolutionizing production efficiency and product quality. The O'Reilly 2024 Tech Trends Report emphasizes that industries leveraging advanced technologies are gaining a competitive edge, improving operational insights, and enhancing customer satisfaction. In this landscape, the ability to quickly innovate and meet global needs with high-quality CPP translucent films will be crucial. The interaction between technological advancements and market demands is shaping a new era, ensuring that businesses remain relevant and competitive in the international market.